Are You Prepared for the January 12 USDA Report? Here are Helpful Tools to Prepare for the Big Day

This is the time of the year it is easy to get lost in the post-harvest cloud of “stuff.” After all, you have had a long, hard, harvest season. In fact, it seems like you just finished planting! Then the fall, as cold, wet harvests often do, they drag on and on and on. The holidays sneak up on you, and you’re just getting around to closing the books on another year. Then, there are meetings with your accountant and lender–and let’s not forget about the mountain of paperwork that has accumulated on your desk from three long months of harvest! And just like that, it’s January 12!

You may be wondering what is so special about January 12? It is when the USDA reports the final production numbers for the 2017 crop year. From this report forward acres and yield are fixed. This is the report I like to call the “Big Game” of USDA reports and for good reason. After January 12, the supply side is fixed and the USDA can only adjust the demand side of the supply and demand balance sheet. And with record stocks stored on farms, tucked away in grain bins, this means all those unpriced bushels are at risk.

Market fluctuations shortly after the report are largely caused by a change in expectations, which can leave your unsold grain production at risk if you are not prepared.

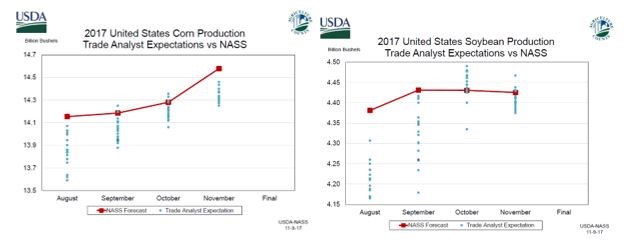

Market analysts will all be out in force with their pre-report trade guesses just after the New Year. However, when the analysts’ expectations deviate from the report numbers, this often creates a market move. Just look at the deviation we experienced with the November World Agriculture Supply and Demand Estimates (WASDE) on both corn and soybeans:

This deviation causes the “surprise” and market reacts accordingly. But, there is no need to wait until the “Big Game” to get your team ready. In fact, getting your marketing plan in order post-harvest is actually a great first step!

However, this can be a challenging task.

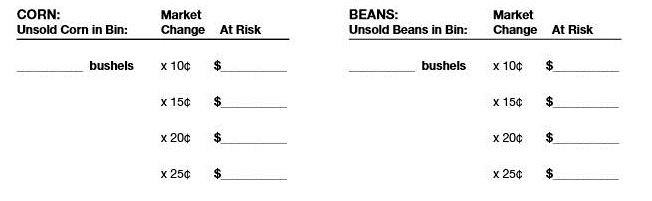

One simple calculation to consider: Take the number of unsold bushels in storage and understand the value at risk given a market move. I have included a simple worksheet below to calculate this variable for your unsold production for corn and soybeans.

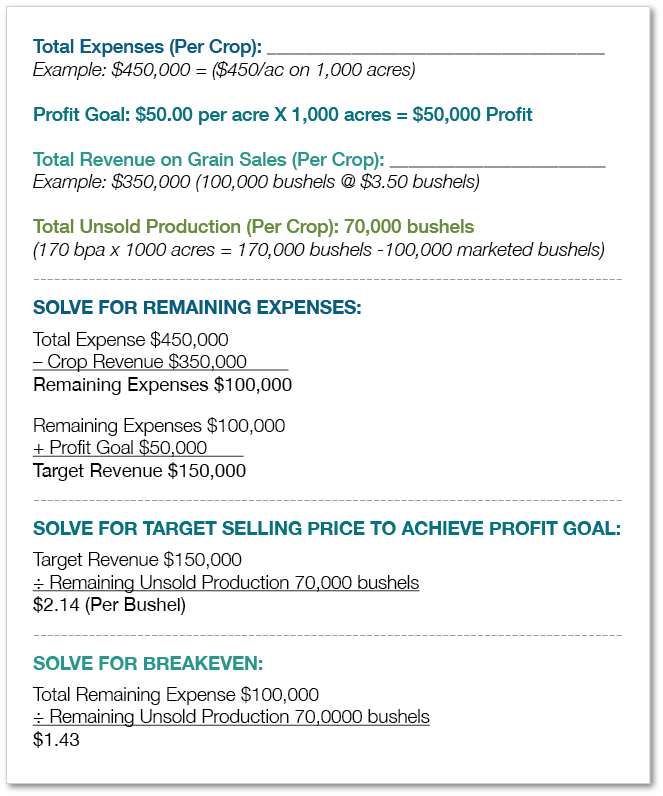

The prep for this report doesn’t stop with just understanding how a market moves impact on your unsold production. You need to understand the prices needed to remain profitable as well. Chances are, it’s been a while since you have thought about your break even on your corn and soybean crops. Post-harvest is actually a great time to revisit the topic.

The prep for this report doesn’t stop with just understanding how a market moves impact on your unsold production. You need to understand the prices needed to remain profitable as well. Chances are, it’s been a while since you have thought about your break even on your corn and soybean crops. Post-harvest is actually a great time to revisit the topic.

By this time, you know how much you have invested in the crop and what it produced. You have probably even made some sales along the way. But do you know where you are profitable? This is a very difficult equation to solve. It requires totaling your expenses for the year for each crop, determining a profit goal, calculating the value of marketed grain, solving for unsold production, solving for breakeven and formulating a target price. So, I’ve created another simple worksheet that can help you get ready for report day by filling in a few blanks:

Of course, we can help, too. Your Cargill Risk Management team is here to help you with your OTC hedging needs.

These materials have been prepared by personnel in the Sales and Trading Departments of Cargill Risk Management, a business unit of Cargill, Incorporated based on publicly available sources, and is not the product of any Research Department. These materials are not research reports and are not intended as such. These materials are for the general information of our customers and are a “solicitation” only as that term is used within CFTC Rules 1.71 and 23.605, as promulgated under the U.S. Commodity Exchange Act. These materials are provided for informational purposes only and are not otherwise intended as an offer to sell, or the solicitation of an offer to purchase, any swap, security or other financial instrument. These materials contain preliminary information that is subject to change and that is not intended to be complete or to constitute all of the information necessary to evaluate the consequences of entering into a swap transaction and/ or investing in any securities or other financial instruments described herein. These materials also include information obtained from sources believed to be reliable, but Cargill Risk Management does not warrant their completeness or accuracy. In no event shall Cargill Risk Management be liable for any use by any party of, for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained in these materials and such information may not be relied upon by you in evaluating the merits of participating in any transaction. All projections, forecasts and estimates of returns and other “forward-looking” information not purely historical in nature are based on assumptions, which are unlikely to be consistent with, and may differ materially from, actual events or conditions. Such forward-looking information only illustrates hypothetical results under certain assumptions. Actual results will vary, and the variations may be material. Nothing herein should be construed as an investment recommendation or as legal, tax, investment or accounting advice. Cargill Risk Management is a provisionally registered Swap Dealer and operates under “Order of Limited Purpose Designations for Cargill, Incorporated and an Affiliate.”