Corn and Soybeans: The Start of a New Supercycle in Agriculture?

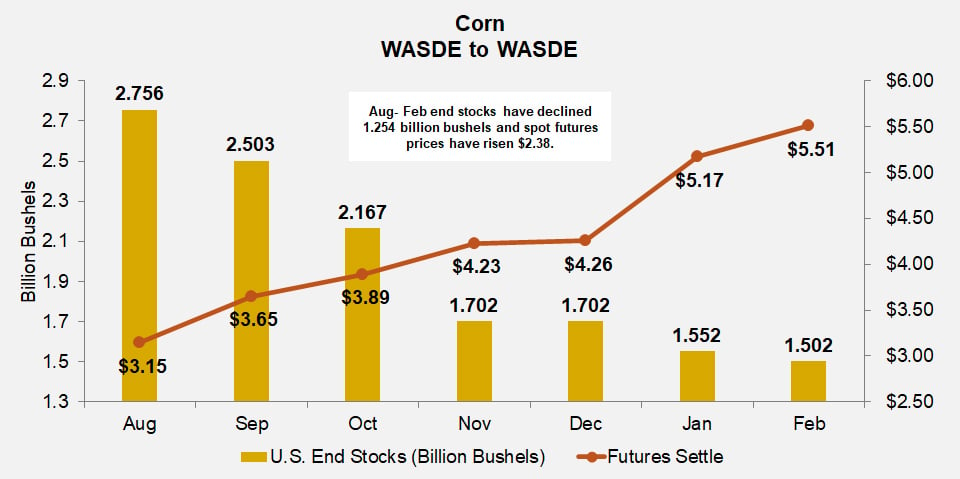

August 2020 probably seems like a lifetime ago in commodities. Oil had recently shocked the world by going negative for the first time ever. With commuters working from home, gasoline and ethanol demand were significantly curtailed. Meanwhile, corn and soybeans seemed plentiful with high stocks, relatively low prices and an outlook for more of the same.

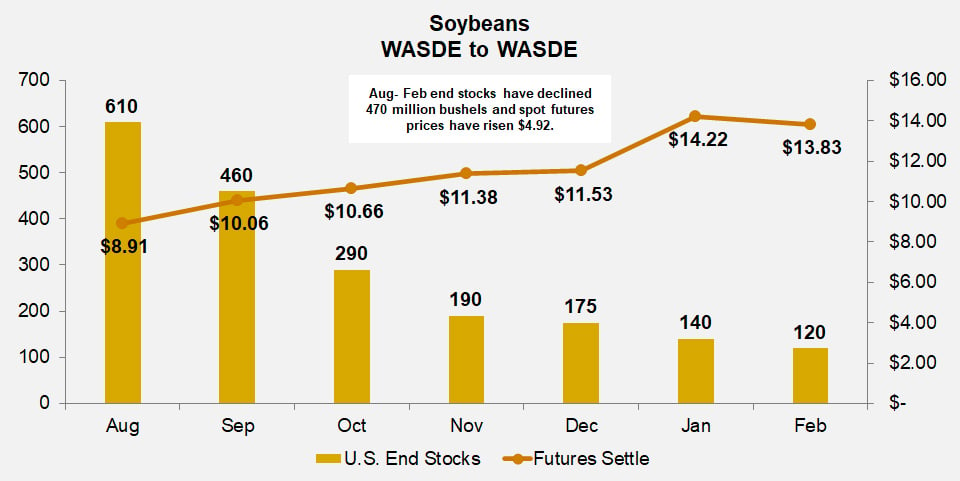

Today, it’s a completely different story. Oil has bounced back to pre-pandemic levels. And corn and soybeans have tightened up due to strong global demand.

Source: USDA, Reuters

Source: USDA, Reuters

Source: USDA, Reuters

Source: USDA, Reuters

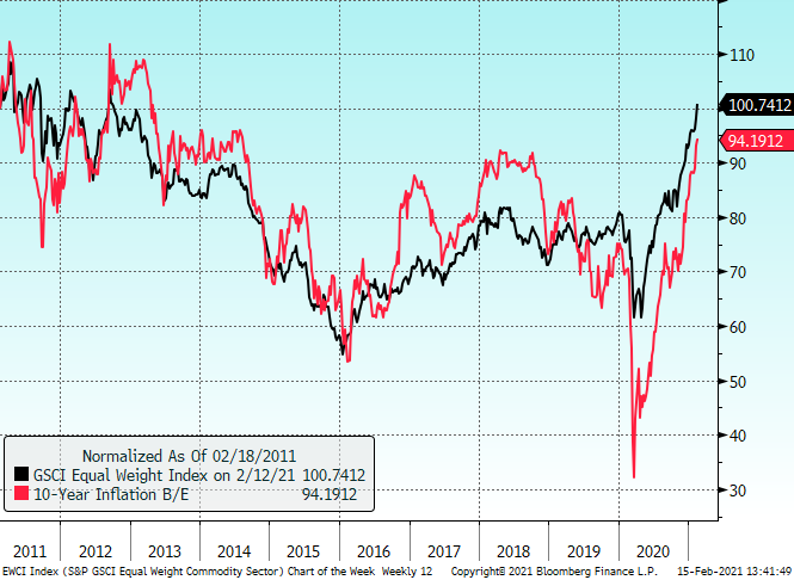

Tack on high prices in certain metals, natural gas and more, and some analysts have declared the start of a new commodities supercycle after a decade of low prices and low volatility.

This leaves those exposed to the price of agricultural commodities wondering two things: What drove the change, and should we expect it to continue?

The perfect intersection

It’s hardly a surprise that the larger economy could be well on its way to overheating. Roaring consumer spending is nearly a given as fiscal stimulus continues and populations get vaccinated and start leaving home again. For the first time in more than 10 years, a basket of commodity prices is now consistently outpacing the 10-year breakeven projection, according to Goldman Sachs.

Source: Bloomberg

Source: Bloomberg

This means the market is pricing in inflation, which has left investors looking for a safe place to park capital. Commodities – especially the relatively low-price and low-volatility agricultural sector – has become the irresistible destination. But agricultural commodities don’t exist in a vacuum. This inflationary hedge has coincided with particular circumstances in agricultural markets to drive a new surge of volatility.

First, industry projections for stocks in the second half of last year ended up being too optimistic. The actual crop in the bins was lower than many thought. And dryness in parts of the U.S. grain belt, as well as the derecho wind superstorm in Iowa, notably reduced corn and soybean yields. Meanwhile, higher oil prices also exerted an upward pull on ethanol, with a corresponding rise in demand for corn as a feedstock.

Then, China came to the global market with a strong demand for corn, in particular. Usually, China produces most of its own corn, but the country drew down reserves as its meat industry rebounded from African swine fever and its population emerged from the pandemic. For various reasons, other common sources of corn like Brazil, Argentina and Ukraine could not fully meet the stepped up demand. Because of this and a weakening U.S. dollar that encouraged exports, the world looked to the U.S. for corn – and to a lesser extent, soybeans – only to find less available than previously anticipated.

Prices responded accordingly to this interplay of fund activity and fundamentals, climbing steadily.

The next chapter in the story

After the whirlwind reversal of the past five months, the question is what to do about corn and soybean exposure going forward. We will shortly be turning the corner into planting season in the U.S., and with this new higher floor set for prices, expect farmers to plant as much as possible.

From the time the U.S. Department of Agriculture releases its report on planting intentions in March to the final number of acres planted in June, it’s reasonable to expect some consolidation and a pause in the price rally.

This pause in the price rally may be encouraged by Brazil’s late-arriving soybean crop, which is being hampered by heavy rains. When Brazilian farmers made their planting decisions six months ago, the Brazilian real was at its weakest point all-time against the U.S. dollar. Although that trend has since reversed, at the time it caused Brazil’s farmers to plant heavily for soybeans. When that large crop does start to make its way into export channels in the coming months, it could also weigh on global prices for a time.

But there are several reasons to think that this pause in the rally may be muted or short-lived. The world will still be very tight on corn and soybeans, so any weather hiccups in the U.S. will have outsized impacts. The National Oceanic and Atmospheric Administration is already forecasting an elevated probability for a La Niña event this spring.

Plus, because Brazil’s soy crop is well behind the typical harvest pace, farmers there can’t plant their safrinha (or second) corn crop until they get their beans out of the ground. Meanwhile, demand from China is not going away.

All of this, combined with the inflationary hedge into commodities mentioned above, could mean that we see the price rally continue into the later part of the year or beyond.

This calls for a prudent and disciplined approach. Those hedging corn or soybean exposure should have structures in place to take advantage of any temporary market pull back. Cargill Risk Management can help provide solutions based on your needs.

The era of low prices and low volatility in agricultural commodities may very well be on its way out for the foreseeable future. Users of corn and soybeans who have gotten accustomed to that environment over the past five years should have a plan in place to deal with the new circumstances.

These materials have been prepared by personnel in the Sales and Trading Departments of Cargill Risk Management, a business unit of Cargill, Incorporated based on publicly available sources, and is not the product of any Research Department. These materials are not research reports and are not intended as such. These materials are for the general information of our customers and are a “solicitation” only as that term is used within CFTC Rules 1.71 and 23.605, as promulgated under the U.S. Commodity Exchange Act. These materials are provided for informational purposes only and are not otherwise intended as an offer to sell, or the solicitation of an offer to purchase, any swap, security or other financial instrument. These materials contain preliminary information that is subject to change and that is not intended to be complete or to constitute all of the information necessary to evaluate the consequences of entering into a swap transaction and/ or investing in any securities or other financial instruments described herein. These materials also include information obtained from sources believed to be reliable, but Cargill Risk Management does not warrant their completeness or accuracy. In no event shall Cargill Risk Management be liable for any use by any party of, for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained in these materials and such information may not be relied upon by you in evaluating the merits of participating in any transaction. All projections, forecasts and estimates of returns and other “forward-looking” information not purely historical in nature are based on assumptions, which are unlikely to be consistent with, and may differ materially from, actual events or conditions. Such forward-looking information only illustrates hypothetical results under certain assumptions. Actual results will vary, and the variations may be material. Nothing herein should be construed as an investment recommendation or as legal, tax, investment or accounting advice. Cargill Risk Management is a provisionally registered Swap Dealer and operates under “Order of Limited Purpose Designations for Cargill, Incorporated and an Affiliate.”