Six steps for farmers to improve profitability

Overall, the last few years have been a boon to U.S. farmers, with many seeing both high yields and high prices. But this is far from typical when you look at historical trends. For those who may have stopped using fundamental risk management tools during that stretch, now is the time to get back to basics.

This year, the cost of production is likely to reach all-time highs, and global markets remain very volatile. Sticking to a disciplined risk management approach will be more important than ever. As we head into planting in the U.S., here are some ways that farmers can use sound risk management principles to help increase profitability.

- Define the cost of production and profitability goals

Most farmers enter planting season with a sense of the acres they’ll plant, approximate costs and expected yields. Often, this analysis centers on price. But now is the time to get specific by defining targets – which will help with creating a plan for the entire year.

For instance, look closely at the factors above, but also crop insurance coverage, market sentiment, on-farm storage and percentage already sold. With all these critical variables defined, a profit goal per acre can be defined. Rather than thinking about this in pure dollar terms, farmers may benefit from examining it through Return on Investment, aiming for 20% over a five-year average. This can be the basis for outlining a whole farm marketing plan focused on profitability.

- Write a marketing plan – and share it with a trusted partner

Once profitability goals have been defined, now what? The next step is to create a written marketing plan that lays out an approach for selling crops. Farmers can use a simple spreadsheet or a subscription service, but the intent is to have clear percent sold targets by certain dates.

A key part of this plan is sharing it with a trusted partner. A second set of eyes is crucial both to look for blind spots and to stick to the plan as the year progresses (see below on the value of staying disciplined). Whether it’s a banker, a grain rep, or a spouse, this person is like an athletic trainer who will make sure a farmer is on target to meet their farm’s financial fitness goals. They’ll also help prevent the latest headline from being a distraction.

- Stay disciplined, diverse and consistent

The last few years may have reinforced some bad lessons. For instance, during the counter-seasonal move in 2020 there were steady price rises through harvest, meaning that those who did nothing to manage risk or implement a plan might have been better off in some cases. That’s not typical, because prices tend to drop as the season progresses. In 2021 and 2022, prices were slightly lower at harvest but still far higher than historical averages for that time of year (see below). Regardless of the circumstances of an individual year, the key is to stick to one’s plan.

Diversification also matters. Farmers should use multiple tools to protect themselves. Cash futures and other traditional products are just the beginning. Farmers can also consider products like options to diversify a total marketing plan for the year – just like someone would through a 401k or other retirement vehicle.

- Remove emotion and biases from decision-making

Farming is an emotional business – especially when it’s a family’s legacy and future that’s on the line. But that’s all the more reason not to succumb to common biases that can divert one’s focus and cause a loss of discipline.

Three relevant emotional blinders are: recency bias (using the most recent past events to predict the future); negativity bias (allowing bad experiences to outweigh good ones); and loss aversion (losses impact us emotionally 2.5 times more strongly than gains). Sticking to a plan helps remove emotion. That’s why the plan is there.

Still, a healthy dissatisfaction is helpful. Overconfidence, groupthink, and confirmation bias (spotting information that reinforces your preconceived assumptions) are just as dangerous as biases with negative sentiments. Once again, stick to the plan.

- The seasonal trend is your friend

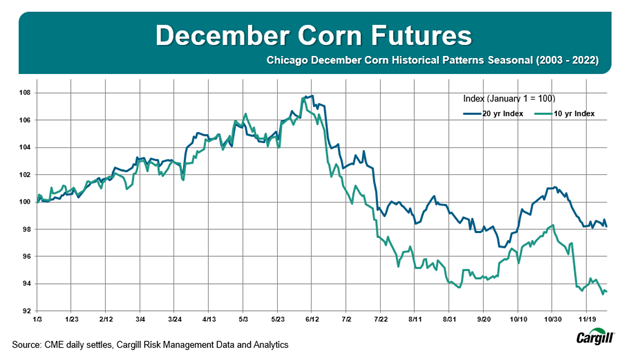

History has important lessons for all of us, and one of those is that there are clear inflection points in the crop cycle. As the chart below shows, there is a sweet spot for prices that is fairly consistent over many years. Last year, the peak price was May 16. Typically, somewhere from late April to early June is when farmers can expect to see the high-water mark.

That’s why now is the time to define a marketing plan, so farmers head into that window with a strong plan in place.

6. Maintain flexibility

Of course, having a plan doesn’t mean that farmers never make adjustments. Careful analysis and strategic responses are always prudent.

That’s why farmers will want the ability to correct course as they go. For example, options can be used as a tool to manage the crop price in fluid markets.

Flexibility like this does more than just protect a farmer’s bottom line. It also gives peace of mind throughout the year. Because surprises will occur. Having a plan with built-in flexibility is key.

What’s next

After a few lucrative and stable years of good production and strong prices for U.S. farmers, this year may represent a return to trend lines. No matter the market conditions, defining a plan and sticking to it can mitigate volatility.

For more information on the approaches and tools mentioned above, contact Cargill Risk Management or visit our website.