Three Indicators to Start You Down the Technical Analysis Path - Part Two

We started the conversation about the three indicators you can use to start you down the technical analysis path in Three Indicators to Start You Down the Technical Analysis Path - Part One. If you haven’t read it, I recommend starting there. The following information builds on that article by tying it all together.

Here’s a quick reminder of the three basic types of technical tools and indicators:

- Candlesticks capture the open, close, high and low prices for a given period of time, as well as the overall intensity and direction of trading.

- Moving averages provide a weighted look at what prices have been doing during various intervals of the recent past and can also give a good glimpse into market sentiment.

- Fibonacci retracements are based on the golden ratio and the sequence of numbers studied by Fibonacci. These sequences are found everywhere in nature, and at some point, traders noticed that price movements and ensuing retracements can correlate to them as well.

How the indicators work together

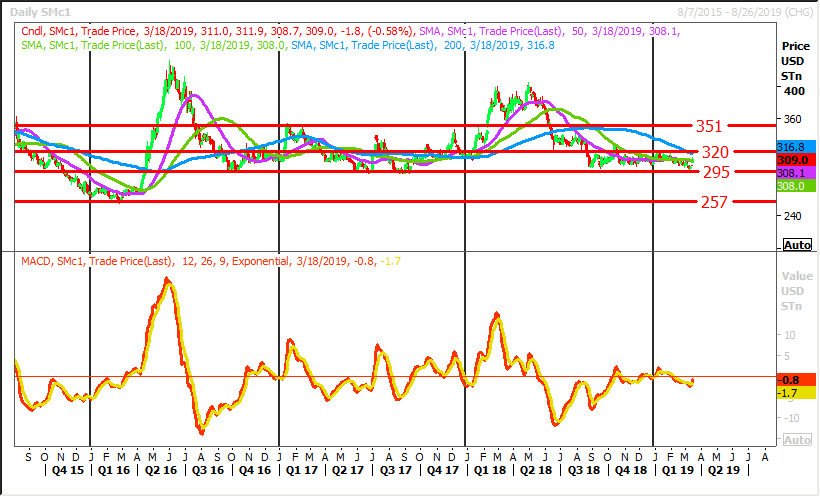

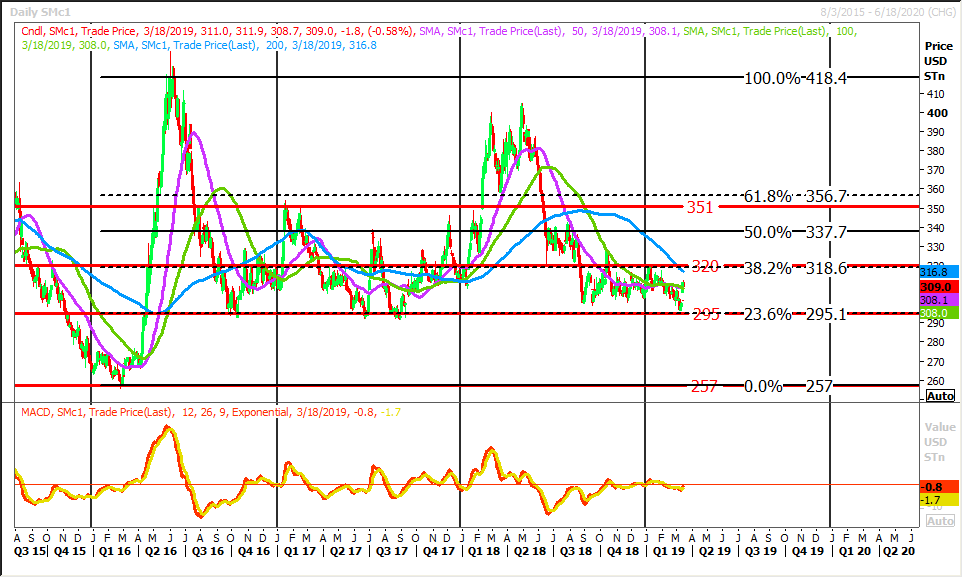

The following series of charts layers the technical analysis indicators together to give a more complete picture.

Source: Reuters

Source: Reuters

Setting up your graph with a candlestick pattern will help you identify trading patterns. Before adding more technical tools, take a second to identify obvious trends.

Source: Reuters

Source: Reuters

This chart shows short-term trends up and short-term trends down, but by drawing support and resistance lines, you can identify a long-term range pattern.

Source: Reuters

Source: Reuters

Simple moving averages of 50, 100 and 200 days remove the noise from strong market moves and allow you to identify levels where the market has traded the most for a specific period.

Source: Reuters

Source: Reuters

A Fibonacci retracement will confirm the technical levels identified by other technical tools and will give us additional support and resistance levels that other market participants are using as well.

How did we do?

The main goal of a technical analysis is to complement your market analysis based on fundamental factors. In this historical case:

- We were able to identify strong support levels defined by lower and higher market prices during a specific period, and we marked them with red lines.

- These technical levels were confirmed by the Fibonacci retracement that tell us market prices tend to move up or down in a numerical relation.

- Additionally, the 50-, 100- and 200-day moving averages have given us levels that represent a compromise between buyers and sellers, meaning that on average, these are the levels where buyers and sellers have come to an agreement the most.

This technical and statistical information will add value to your market analysis and will be most important when fundamental factors are affecting market prices but their full impact is yet to be confirmed.

One common example of this is when there is damage to a crop that will affect its supply and make its price move. Until there is a clear understanding of the damage and its impact, the market will trade within technical levels because that is the information readily available. As more fundamental information arrives, the market price will adjust accordingly and may still follow some of those support and resistance levels set in your original technical analysis.

Take the leap

Technical analysis can provide a powerful context to price movements and help you decipher the sentiment of the market, and the three described above are just the beginning.

Technical analysis should be paired with caution, of course. Its conclusions may differ from the conclusions reached purely from the fundamentals. It presupposes that market prices have already absorbed all the fundamental information and biases that are available. Finally, it assumes some basic philosophies such as that history repeats itself, that the market moves in trends and that the market is essentially irrational.

Keeping these caveats in mind, there is real value in using technical analysis. In particular, it provides a rich view of what other market participants are likely thinking. In fact, because so many participants use its principles, this may be its most powerful aspect – simply understanding what many other people are likely to assume about the market’s trends. Without this information, you may have blinders on as you make your own decisions about how prices will move in the near future.

For this reason, if you have been hesitant to start using technical analysis, you may be at a disadvantage. It could be time to let go of your reluctance and take the leap.

These materials have been prepared by personnel in the Sales and Trading Departments of Cargill Risk Management, a business unit of Cargill, Incorporated based on publicly available sources, and is not the product of any Research Department. These materials are not research reports and are not intended as such. These materials are for the general information of our customers and are a “solicitation” only as that term is used within CFTC Rules 1.71 and 23.605, as promulgated under the U.S. Commodity Exchange Act. These materials are provided for informational purposes only and are not otherwise intended as an offer to sell, or the solicitation of an offer to purchase, any swap, security or other financial instrument. These materials contain preliminary information that is subject to change and that is not intended to be complete or to constitute all of the information necessary to evaluate the consequences of entering into a swap transaction and/ or investing in any securities or other financial instruments described herein. These materials also include information obtained from sources believed to be reliable, but Cargill Risk Management does not warrant their completeness or accuracy. In no event shall Cargill Risk Management be liable for any use by any party of, for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained in these materials and such information may not be relied upon by you in evaluating the merits of participating in any transaction. All projections, forecasts and estimates of returns and other “forward-looking” information not purely historical in nature are based on assumptions, which are unlikely to be consistent with, and may differ materially from, actual events or conditions. Such forward-looking information only illustrates hypothetical results under certain assumptions. Actual results will vary, and the variations may be material. Nothing herein should be construed as an investment recommendation or as legal, tax, investment or accounting advice. Cargill Risk Management is a provisionally registered Swap Dealer and operates under “Order of Limited Purpose Designations for Cargill, Incorporated and an Affiliate.”