Understanding Your Risk Through Stress Testing

A snapshot, a photo, a moment in time – when you are managing your risk, being able to test against a moment in time is vital. In this article, we will explore why using stress testing and Value at Risk (VaR) can support your risk management goals.

Let’s start with some definitions

Stress testing is a simulation technique used to evaluate a portfolio against underlying futures price movement. This can help determine portfolio risk and show how market price movements could potentially impact that portfolio. It also helps our customers identify mitigating or strategic actions and controls for specific scenarios.

Value at Risk (VaR) shows the maximum loss for a given probability during a certain period of time. A stress test is essentially an exercise to explore how changes in market conditions affect our estimates for VaR.

A quick overview of stress testing

As mentioned earlier, a stress test can help teach you how your position may behave in a variety of scenarios. At Cargill Risk Management, we use two scenarios when we conduct a stress test for customers. The two scenarios use similar methodologies, and each is based on the underlying futures price movement. Here’s how that is calculated:

Determine the previous day’s closing price

Move that closing price two standard deviations, using an implied volatility or a 50-day published historical volatility, to a 95 percent degree of confidence.

Move that closing price two standard deviations, using an implied volatility or a 50-day published historical volatility, to a 95 percent degree of confidence.

Once the underlying futures price movement is established, we can perform the scenario analyses:

Scenario #1: Five-day stress move

This gives us an idea of how much the market might move within the immediate five-day period. This scenario assumes there is some discipline in place, where you review these positions on a weekly basis. This could be a weekly meeting or another weekly routine where you consider the scenarios to help you proactively consider how you will act or rebalance depending on what happens during a given week.

Scenario #2: Potential Stress Move

This gives us an idea of how much the market might move over a longer period of time (until the expiration of positions) and can be considered an extreme, yet plausible, scenario.

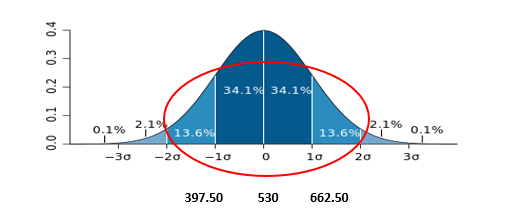

Implied volatility WH0 (@530) = 25%?

95% confidence that the price will move within 397.50 cents/bushel and 662.50 cents/bushel

Why stress testing is important

There are many factors that affect the market – supply and demand, crop yields and the associated weather trends, trade wars and many more.

A stress test is a good exercise to help you and your team understand your positions and make decisions about whether to keep moving forward with what you have in place or make changes to your portfolio.

At Cargill Risk Management, stress testing is one vital component of building comprehensive hedging and risk management discipline. Recurring stress testing helps your team and company go through the paces of different financial scenarios to lead efforts towards proactive risk identification and action recommendations.

Think about this – when the market goes against your portfolio, how do you currently address it? This type of stress testing helps you prepare ahead of time to be proactive instead of falling back on the emotions that can often bias our decisions. When you have a plan ahead of time, you remove the emotional response from the equation and can act with confidence.

Read more about the market’s irrationality here.

Cargill Risk Management is here to help you think through your challenges and needs – and ultimately find the over-the-counter (OTC) hedging solutions that can help manage your risk. We work with customers to stress test and educate them about how their portfolios behave and what the future could hold.

These materials have been prepared by personnel in the Sales and Trading Departments of Cargill Risk Management, a business unit of Cargill, Incorporated based on publicly available sources, and is not the product of any Research Department. These materials are not research reports and are not intended as such. These materials are for the general information of our customers and are a “solicitation” only as that term is used within CFTC Rules 1.71 and 23.605, as promulgated under the U.S. Commodity Exchange Act. These materials are provided for informational purposes only and are not otherwise intended as an offer to sell, or the solicitation of an offer to purchase, any swap, security or other financial instrument. These materials contain preliminary information that is subject to change and that is not intended to be complete or to constitute all of the information necessary to evaluate the consequences of entering into a swap transaction and/ or investing in any securities or other financial instruments described herein. These materials also include information obtained from sources believed to be reliable, but Cargill Risk Management does not warrant their completeness or accuracy. In no event shall Cargill Risk Management be liable for any use by any party of, for any decision made or action taken by any party in reliance upon, or for any inaccuracies or errors in, or omissions from, the information contained in these materials and such information may not be relied upon by you in evaluating the merits of participating in any transaction. All projections, forecasts and estimates of returns and other “forward-looking” information not purely historical in nature are based on assumptions, which are unlikely to be consistent with, and may differ materially from, actual events or conditions. Such forward-looking information only illustrates hypothetical results under certain assumptions. Actual results will vary, and the variations may be material. Nothing herein should be construed as an investment recommendation or as legal, tax, investment or accounting advice. Cargill Risk Management is a provisionally registered Swap Dealer and operates under “Order of Limited Purpose Designations for Cargill, Incorporated and an Affiliate.”