Portable Snacks with Nutrient Claims Driving Growth in the Category

In 2017 alone, the snack category grew $3.4 billion globally and reached a total of $750.56 million in annual sales in the U.S.

Walking into the center aisles of a grocery store today looks much different than it did 10 years ago.(1) Transforming consumer preferences have influenced food manufacturers to creatively innovate and expand their products, which has driven substantial growth.(2) One grocery category in particular that’s taking the lead is snacks.(3) In 2017 alone, the snack category grew $3.4 billion globally, and reached a total of $750.56 million in annual sales in the United States.(3) However, there are clear separations of sub-categories within snacks that are driving the greatest growth. These sub-categories are very much representative of rising consumer preferences for health, convenience, and of course, taste.(3,4,5)

In an exceedingly fast-paced world, it’s no wonder that snacking has increased in the United States from 59% in the 1970s to 90% in 2009, according to the National Health and Nutrition Examination Study (NHANES) by the Centers for Disease Control and Prevention.(2) Snacking may be a valuable option for people as intensity and workload are rising in schools and workplaces, making it difficult to set aside time to create and eat a well-balanced meal.(1) However, even with these increasingly busy lifestyles, consumers are not always willing to sacrifice health for convenience.(4) The appeal of consumer friendly ingredient labels and perception of health benefits, such as “gluten free” or “non-GMO” effectively speaks to the mindful consumers of today’s snack market.(3,6)

According to Nielsen, the “on-the-go” snacking sub-category has achieved a compound annual growth rate of 10% between 2012 and 2016,(3) while snacking products with certain perceived “health claims” are experiencing even greater growth.(4) For instance, dollar sales for snacks labeled with non-GMO claims grew by 18.2% in the past five years, products that have “free of artificial colors/flavors” claims grew by (16.2%,) and those with “no/reduced sugar” claims experienced growth at 11.3%.(4) “Comparatively, the average snack product has seen an increase of only 1.2%,” Nielsen reports.(4)

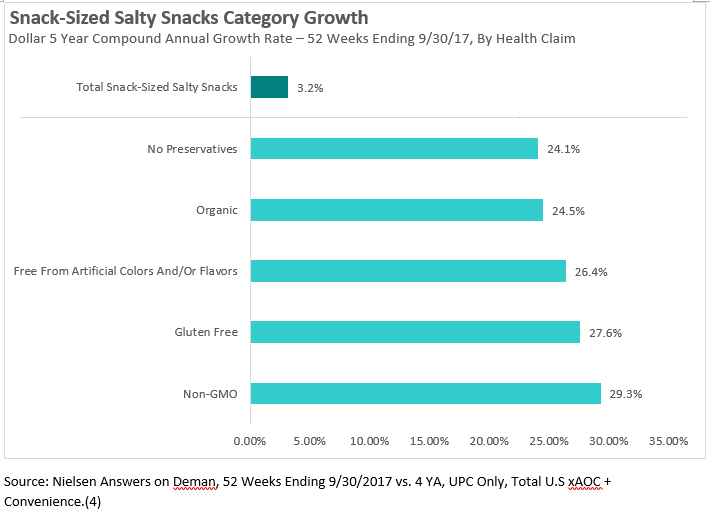

Though health and convenience is at the forefront of consumers’ minds, maintaining taste is also a highly important expectation for shoppers.(5) In today’s competitive market, consumers know they can find products that will check their boxes for health and convenience, while also indulging in an enjoyable, flavorful snacking experience.(5) Perhaps this is why salty snacks earned 6% dollar share growth in 2017, one of the largest increases among the different snacking categories.(4) Aligning with the snack category overall, perceived health-related claims are also playing a role in this sub-category’s significant surge in sales.(4)

It appears the future of snacking may continue to be shaped by the three predominant snacking trends of health, convenience, and taste.(4) To stay competitive, food manufacturers need to continuously evolve their product portfolios with a keen eye on packaging and ingredients. And with respect to a snacking sub-category with promising growth,(4) food manufacturers may want to place a greater emphasis on salty snacks. For food manufacturers, balancing consumers’ apparent desire for reduced sodium options (7) while also maintaining an indulgent taste can be challenging, but fortunately, that’s where Cargill Salt Group can step in.

As one of the largest salt suppliers in the United States, Cargill provides the expertise, tools, and resources to find the right salt formula for varying applications, so that food processors don’t have to worry about their salt. Because Cargill is primarily a food company, we have a broad scope of knowledge across the food industry. This deep knowledge translates into solutions for our customers through Cargill Salt’s full technical support team, including food safety, quality and regulatory (FSQR), and food science experts. At a time when sodium reduction in processed foods is top-of-mind for consumers, this type of support is vital in order to create the right product formulations from a sensory and nutritional standpoint.

For more information on our full range of salt ingredients or our expert support, visit www.cargill.com/food-beverage/na/food-salt, or call 1-888-385-SALT (7258).

Sources:

- Egan, Sophie. “The Problem with How America Snacks Today.” 14 Oct 2017. Accessed on 3 Aug 2018. Retrieved from https://www.thekitchn.com/the-problem-with-how-america-snacks-today-248542

- Brost, Bonnie. “Nutrition: We’ve Become a Nation of Snackers.” 17 Jul 2018. Accessed on 3 Aug 2018. Retrieved from http://www.duluthnewstribune.com/news/4473289-nutrition-weve-become-nation-snackers

- Nielsen FMCG and Retail. “Booming Snack Sales Highlight a Growth Opportunity in Emerging Markets.” 12 Mar 2018. Accessed on 3 Aug 2018. Retrieved from http://www.nielsen.com/us/en/insights/news/2018/booming-snack-sales-highlight-a-growth-opportunity-in-emerging-markets.html

- Nielsen FMCG and Retail. “Individual Snacking Categories on the Rise in the U.S.” 22 Nov 2017. Accessed on 3 Aug 2018. Retrieved from http://www.nielsen.com/us/en/insights/news/2017/individual-snacking-categories-on-the-rise-in-the-us.html

- Crawford, Elizabeth. “Truth Bar Balances Convenience, Function and Flavor. 22 Mar 2018. Accessed on 3 Aug 2018. Retrieved from https://www.foodnavigator-usa.com/Article/2018/03/22/Truth-Bar-balances-convenience-function-and-flavor?utm_source=newsletter_daily&utm_medium=email&utm_campaign=22-Mar-2018&c=QgAX0YFmES%2BDZzX1npt%2FJhY0TPrHhTPH&p2

- Bosse, Angelina. “Snaxpo 2018 Insights: The Top 5 Snack Trends in North America.” 29 Mar 2018. Bosch packaging technology food blog. Accessed on 10 Aug 2018. Retreieved from http://foodblog.boschpackaging.com/2018/03/29/snaxpo/

- Innova Market Insights. Growth of low sodium health claims, August 2018.